FAQs - Holmes & Cook - award winning experts in evaluating marketing effectiveness

How does econometrics differ from marketing mix modelling?

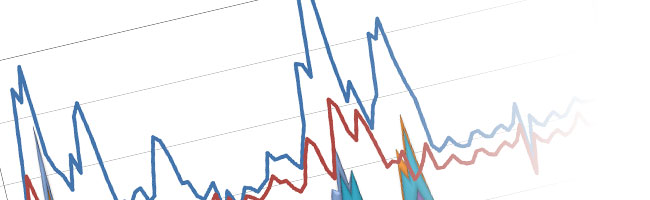

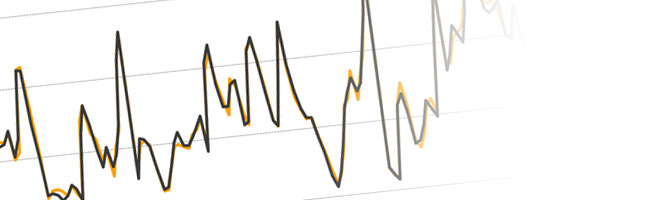

Marketing mix modelling is originally an American term and is now being freely inter-changed with econometrics. This may not always be appropriate though because econometrics has a very specific approach and philosophy not shared by all statistical disciplines. Econometricians are particularly interested in ensuring their models have a correct theoretical structure i.e. that they do not simply find correlations between sales and the various marketing levers but capture the appropriate short and long-run relationships between them. Econometricians are also concerned with the technical validity of models. A wide range of econometric validation tests have been developed in recent years which specifically acknowledge the properties of marketing and economic data and which econometricians employ.

I have heard other terms in association with econometrics but am not clear about their role?

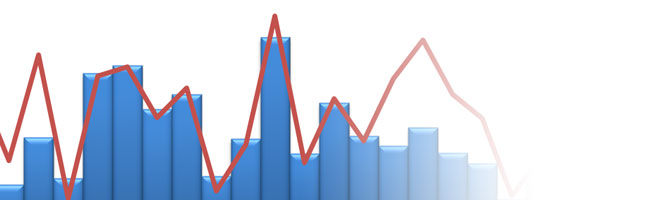

Econometrics is often discussed in the context of marketing or advertising efficiency, ROI, brand value management or customer value management. By analysing the patterns in historic consumer response, and quantifying what happens to e.g. sales when a particular marketing lever is pulled, its results help to devise strategies which will improve efficiency and generate value. For a detailed explanation and report please click here.

Do I need econometrics?

The three most powerful attributes of econometrics are its ability to identify, separate and quantify the influence of key factors on sales. If you are struggling to understand why your sales are going in a particular direction, if you can’t tell what is doing what or if your boss or the Finance Director are pushing you to show what return you got on that media or promotional investment, then econometrics probably can help.